change in net working capital as a percentage of change in sales

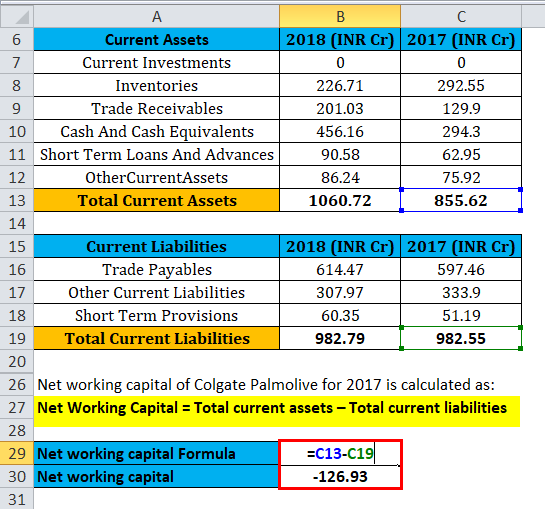

At the very top of the working capital schedule reference sales and cost of goods sold from the income statement for all relevant periods. Net Working Capital Formula Current Assets Current Liabilities.

What Is Net Working Capital How To Calculate Nwc Formula

Plus as revenues rise or fall net working capital tends to stay constant as a percentage of sales.

. Change in Inventory 9497 8992 505. The NWC relative to sales varies by industry as net working capital can represent 2 of sales or even 20 of sales. The business would have to find a way to fund that increase in its working capital asset perhaps by selling shares increasing profits selling assets or incurring new debt.

For the year 2019 the net working capital was 7000 15000 Less 8000. Here are some examples of how cash and working capital can be impacted. Related to Working Capital as a Percentage of Sales.

Compare the ratio against other companies in the same industry for additional. B Take change in NWC from 16 to 17 as of sales. For working capital add the accounts receivable 8333 and inventory 12500 then subtract accounts payable 1042.

The ratio will determine whether the business has a positive or negative working capital. The sales to working capital ratio is calculated by dividing annualized net sales by average working capital. Likewise calculate for the rest of the years.

The formula is working capital divided by gross sales times 100 For example if working capital amounts to 140000 and gross sales are 950000 working capital as a percentage of sales is 1474 percent. Under sales and cost of goods sold lay out the relevant balance sheet accounts. If a business has high operating leverage then there.

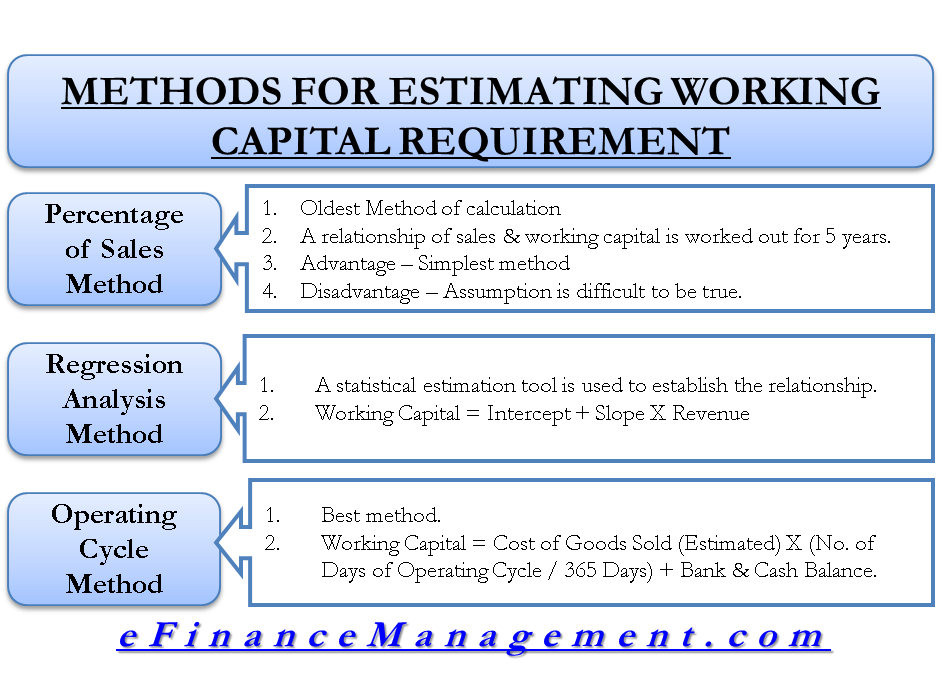

The working capital to sales ratio uses the working capital and sales figures from the previous years financial statements. Change in Net Working Capital 12000 7000. The percentage of sales method is the simplest and easiest way of finding future working capital.

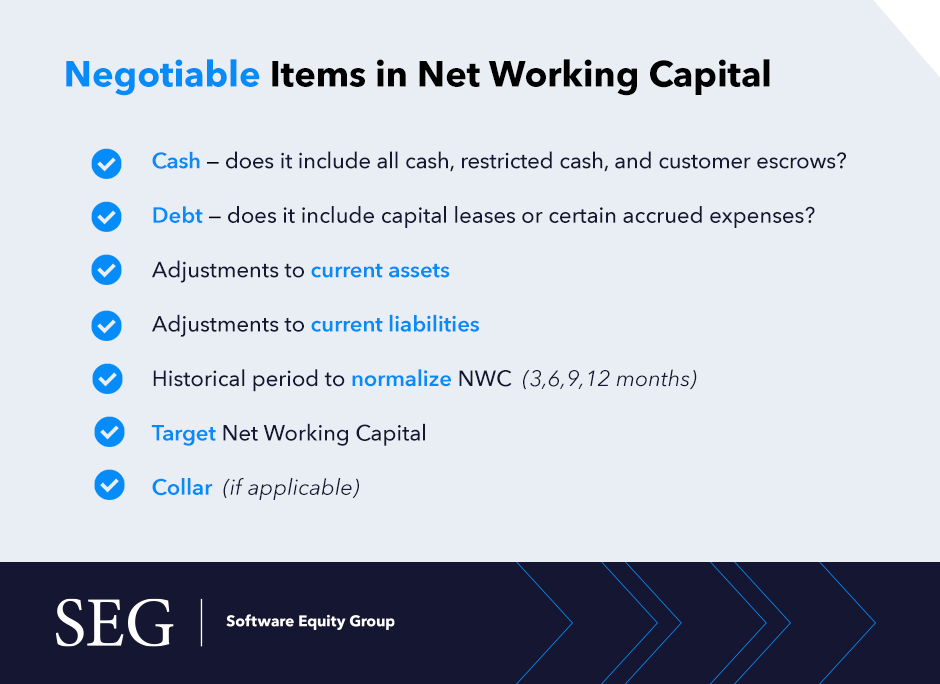

As used herein NWC means a the Net Book Value of the current assets of the Business listed on Section B-2 of the Disclosure Schedule less b the Net Book Value of the. In general the higher the number the more financial risk is involved in company operations as it takes a higher degree of assets to run short-term operations. These will be used later to calculate drivers to forecast the working capital accounts.

You just need to minus the current years working capital from last years. Now changes in net working capital are 3000 10000 Less 7000. If a business requires a lot of current assets to generate sales and those assets are funded by cash then the net working capital as a percentage of sales will likely be high.

Working capital as a percent of sales is calculated by dividing working capital by sales. Calculation of the Sales to Working Capital Ratio. Now lets break it down and identify the values of different variables in the problem.

The sales to working capital ratio is calculated by dividing annualized net. This means that for a company with positive net working capital NWC will grow as sales grow and be a use of cash. Change in Net Working Capital 5000.

And Change in Net Working Capital is an integral part to arrive at the value of Free Cash Flow which is used in valuation and financial modelling. First each component of working capital as a percentage of sales is calculated. First each component of working capital as a percentage of sales is calculated.

It comprises inventory cash. Working Capital Turnover Net Sales Average Working Capital. Now changes in net working capital are 3000 10000 Less 7000.

Net Sales Total Revenue - Cost of Sales Returns Allowances Discounts You then calculate the turnover ratio. The reason is that the current asset Cash increased by 50000 and the current liability Loans Payable increased by 50000. Changes in working capital are reflected in a firms cash flow statement.

To calculate net sales subtract returns 400 from gross sales 25400. Hence there is obviously an assumption that working capital and sales have been accurately stated. If no other expenses are incurred working capital will increase by 20000.

So current assets have increased. For accounts payable are 20 million and sales are 100 million accounts payable as a percentage of sales would be 20. If a transaction increases current assets and.

Change in a Net Working Capital Change in Current Assets Current Assets Current assets refer to those short-term assets which can be efficiently utilized for business operations sold for immediate cash or liquidated within a year. Net Working Capital NWC 75mm 60mm 15mm. If the result is too high eg more than a ratio of 11 the company you are analyzing might be having trouble converting inventory to sales or not enforcing.

If a company borrows 50000 and agrees to repay the loan in 90 days the companys working capital is unchanged. Target Net Working Capital Amount means an amount equal to the four 4 quarter average NWC as defined in this paragraph for 2015 for the Business. The last step is to find the change in net working capital.

Companies may over stock or under stock because of expectations of shortage of raw materials. A Take WC as a of sales each year then use the delta of those two numbers for your FCF impact. The formula is working capital divided by gross sales times 100 For example if working capital amounts to 140000 and gross sales are 950000 working capital as a percentage of sales is 1474 percent.

If a company collects 30000. Either change is moving in a favorable direction or do we need to change our. Secondly the coming years sales forecast is.

Such a trend line is an excellent feedback mechanism for showing management the results of its decisions related to working capital. In this case the change is positive or the current working capital is more than the last year. For year 2020 the net working capital is 10000 20000 Less 10000.

Since the change in net working capital has increased it means that change in current assets is more than a change in current liabilities. But if sales fall a scenario I worry about as a lender NWC may or may not shrink and free up cash to meet loan obligations. In driving Change in NWC impact going forward do you.

It means that the company has spent money to purchase those assets. In-depth Explanation of Working Capital. As mentioned above and you might know Net Working Capital enables analysts and investors to gauge where a company is positioning.

In this example the change in working capital in 2021 comes to be negative -24046000000. Thus if net working capital at the end of February is 150000 and it is 200000 at the end of March then the change in working capital was an increase of 50000. Changes in Net Working Capital Working Capital Current Year Working Capital Previous Year Or.

Change In Net Working Capital Nwc Formula And Calculator

Methods For Estimating Working Capital Requirement

Change In Working Capital Video Tutorial W Excel Download

Net Working Capital Formula Calculator Excel Template

Change In Working Capital Video Tutorial W Excel Download

How To Calculate Working Capital Turnover Ratio Flow Capital

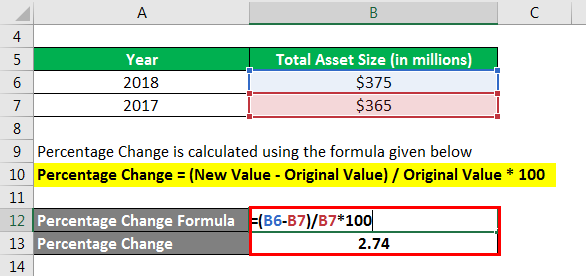

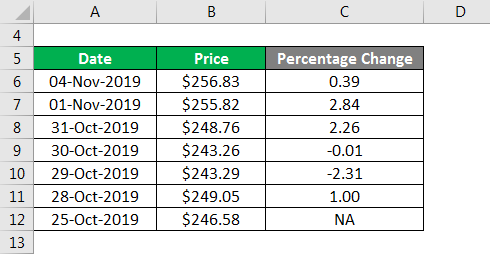

Percentage Change Formula Calculator Example With Excel Template

Change In Working Capital Video Tutorial W Excel Download

Change In Net Working Capital Nwc Formula And Calculator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Change In Working Capital Video Tutorial W Excel Download

Percentage Change Formula Calculator Example With Excel Template

Changes In Net Working Capital All You Need To Know

Percentage Change Formula Calculator Example With Excel Template

Percentage Change Formula Calculator Example With Excel Template

Normal Level Of Net Working Capital At Closing Divestopia

Change In Net Working Capital Nwc Formula And Calculator

Working Capital Turnover Ratio Formula Calculator Excel Template

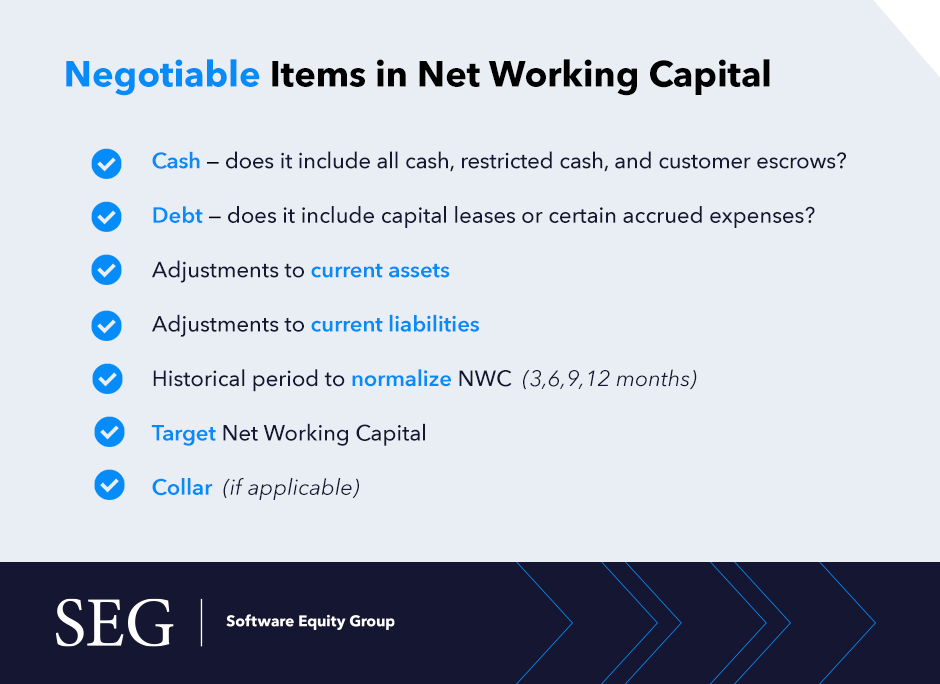

What Is Net Working Capital Nwc In M A Software Equity Group